navigating inspections and appraisals in your home buying journey

The story of 2 tools used in the real estate transaction. They are similar but quite different. We spent the first quarter of the year discussing the financial aspect of the home buying process. If you haven’t read the blog posts, you can read here.

This blog post provides insights from the buyer's perspective, we will cover the seller's role in future discussions regarding inspections and appraisals.

Inspections: The Foundation of Assurance

Inspection is really the beginning of the home buying process; I believe, because it’s really the first point of money being spent. You will order the inspection after your offer has been accepted by the seller. The inspection should be done under 3 days if possible but no more than 7 days.

Home inspections typically will cost $300 - $500, based on the size of the home. The inspector will cover the exterior, roof, basement, HVAC system, and furnace. Although its a comprehensive inspection, it is very standard. If you need or require a more in depth inspection you will have to order those separately such as pools, wells, or septic systems will require additional inspections.

Following the inspection, a detailed report is provided, outlining any major or minor issues discovered. Collaborating with your Realtor, you'll review this report and formulate a repair request within 2 to 3 days, focusing on significant issues rather than minor repairs like GFCI replacements. However, if major items are found you can request a credit, or reduction of purchase price, or possibly a home warranty plan.

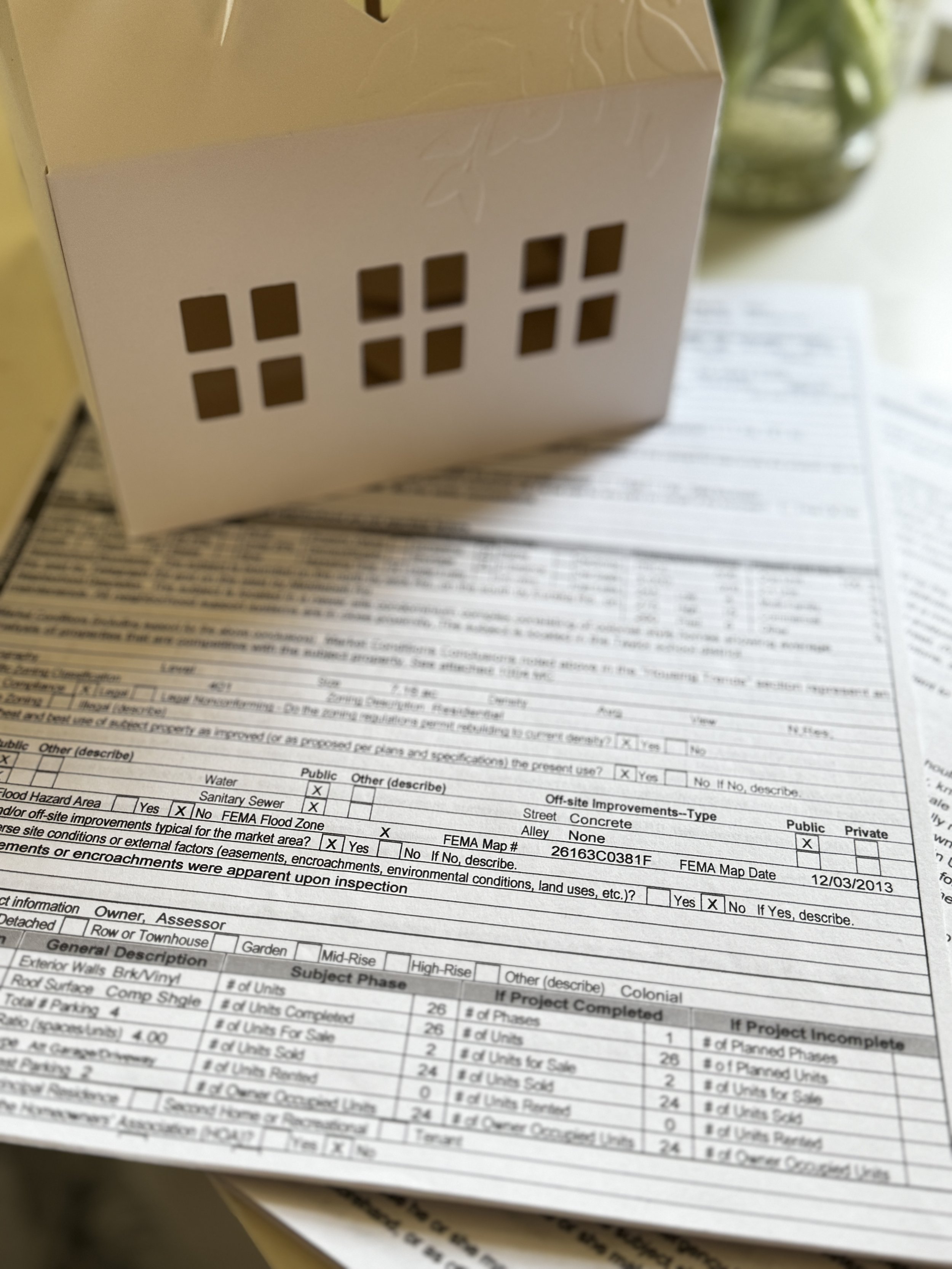

appraisals: evaluating worth

Ordered by the lender and factored into your closing costs, appraisals serve to determine the home's value. Appraisers also consider factors such as condition and amenities that enhance value, such as energy-efficient features or aesthetic upgrades. The appraiser estimates the value of sold comparables with the similar size, style, location, foundation, and condition as well.

In the event that the home appraises below the agreed-upon price, a few options exist:

Negotiate with the listing agent to sell at the appraised value.

You, the buyer, can bring the additional money to closing to cover the difference between the appraised value and the sale price.

As a last resort, you can walk away from the sale. There is a negotiation opportunity here and your Realtor should be happy to guide you through it.

It's crucial to note that lenders will not extend loans exceeding the appraised value, underscoring the importance of informed decision-making.

Ready to embark on your home buying journey armed with knowledge? Reach out today to learn more about navigating inspections, appraisals, and all facets of real estate with confidence.

Let's turn your dream home into a reality together!